Payroll Release Notes Version 23.37.0.0 through 24.39.0.1

These release notes include supplemental information about payroll release version 23.37.0.0 through 24.39.0.1.

Multiple ROE Setup

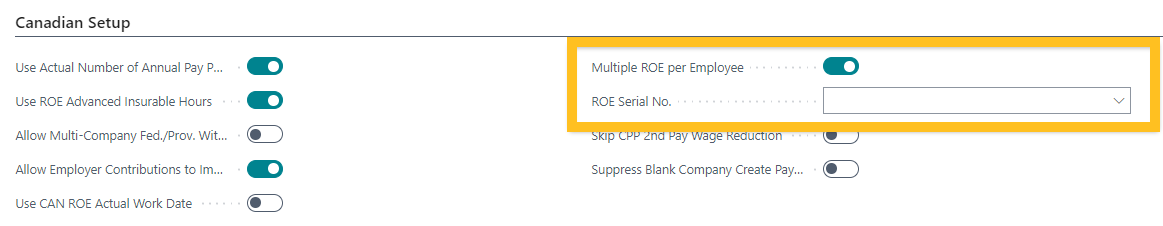

On the Additional Payroll Setup page, on the Canadian Setup FastTab, this release introduces Multiple ROE per Employee and ROE Serial No. fields.

Tip

Tip:

To view the new Multiple ROE per Employee and ROE Serial No. fields, perform the following steps:

- Choose

, enter payroll setup, and then choose the related link.

, enter payroll setup, and then choose the related link.

The Payroll Setup page opens. - On the action bar, choose Additional Setup.

The Additional Setup page opens and the new fields appear on the Canadian Setup FastTab.

When Multiple ROE per Employee is turned on, you must specify a value for ROE Serial No.. The ROE Serial No. field requires an ROE number series to be set up. For more information, see [Create Number Series](../ui-create-number-series.md).

When you export ROE information, the ROE Serial No. field must have a value.

When Multiple ROE per Employee is turned on, you must specify a value for ROE Serial No.. The ROE Serial No. field requires an ROE number series to be set up. For more information, see [Create Number Series](../ui-create-number-series.md).

When you export ROE information, the ROE Serial No. field must have a value.

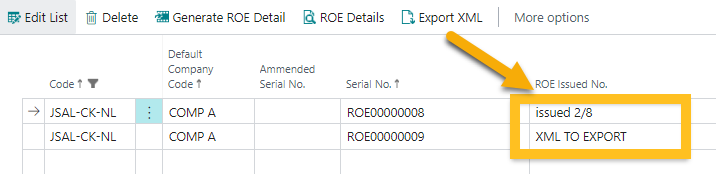

On an ROE that was previously issued, you must specify a value in ROE Issued No.. You can add the ROE serial number or an issued date. On an ROE that you must issue, the ROE Issued No. field displays XML TO EXPORT. If more than one line has XML TO EXPORT populated, all the data that is associated with the lines is exported.

After the ROE serial number information has been updated, you can run the ROE as per your normal process.

Line Order

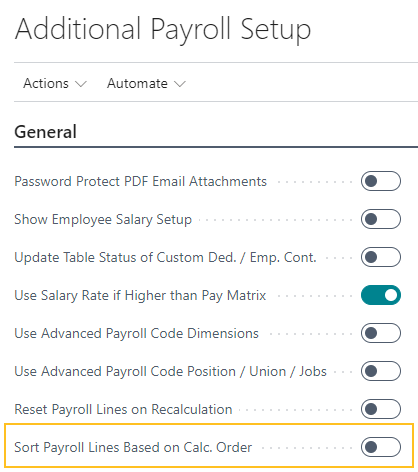

Starting with this release, users can define the payroll line order, despite the payroll type. To turn this feature on, on the Additional Payroll Setup page, on the General FastTab, turn on Sort Payroll Lines Based on Calc. Order.

Additional Payroll Custom Dimensions

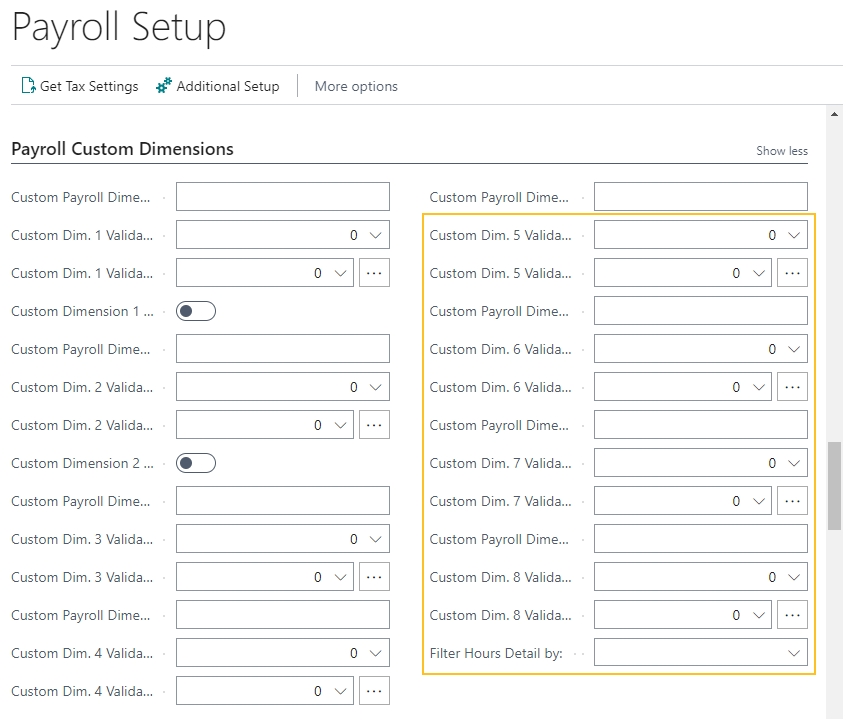

This release adds on the Payroll Setup page, 4 additional custom dimension codes 5-8. In the Filter Hours Detail by field, you can define one custom dimension code to be an hours detail batch filter.

When you specify a custom dimension code in the Filter Hours Detail by field, the specified custom dimension appears on the Create Batch Options page. On the Create Batch Options page, users can specify a value for the custom dimension to filter hours detail, piece rate entry, and employee earnings records.

WH/ER Tax Code

This release introduces a WH/ER tax code. The WH/ER tax code allows you to use different exemption settings for additional withholding or employer tax. The WH/ER tax code is required when there are exemption settings on a state tax that can differ based on company size, and so on.

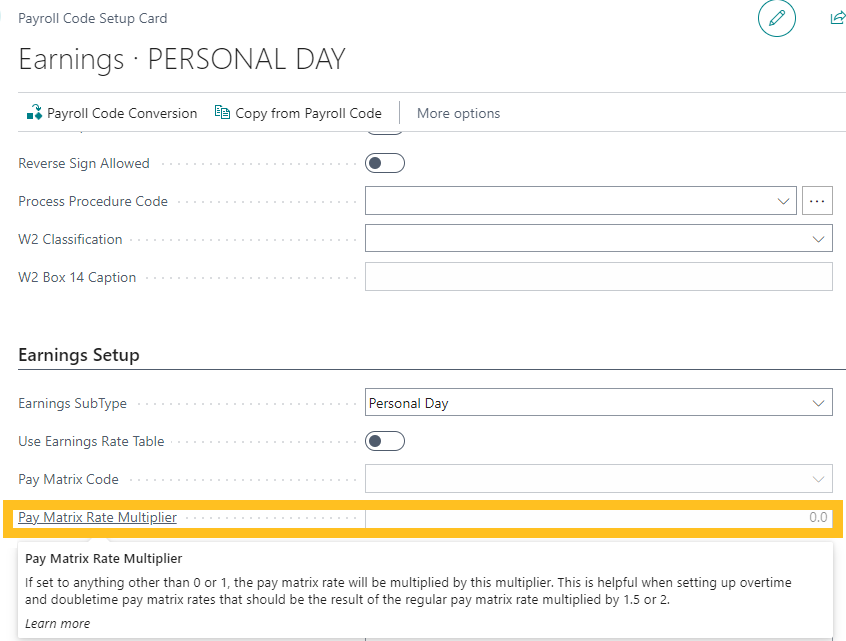

Pay Matrix Multiplier

On the Payroll Code Setup Card page, on the Earnings FastTab, this release introduces a Pay Matrix Rate Multiplier field. If the value of Pay Matrix Rate Multiplier is set to anything other than 0 or 1, the pay matrix rate is multiplied by this multiplier. This functionality is helpful when setting up overtime and double time matrix rates where the result of the regular pay matrix rate is to be multiplied by 1.5 or 2.

Job Queue Distribution of Check Stubs

Starting with this release, the job queue distribution of check stubs now uses the paycheck email message field. This functionality provides the same flexibility that is available from the open batch.

See also

Feedback

To send feedback about this page, select the following link: