Payroll release notes version 22.32.0.0

These release notes include supplemental information about payroll release version 22.32.0.0.

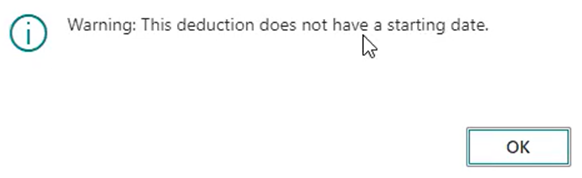

Deduction Code Warning for Starting and Ending Date

When a user tries to set up a new deduction without a starting date or ending date, and then the user tries to exit the deduction setup, Sparkrock Impact now displays a warning.

New Starting and Ending Date Captions in Deduction Card

The captions in the deduction card now display Deduction Starting Date and Deduction Ending Date.

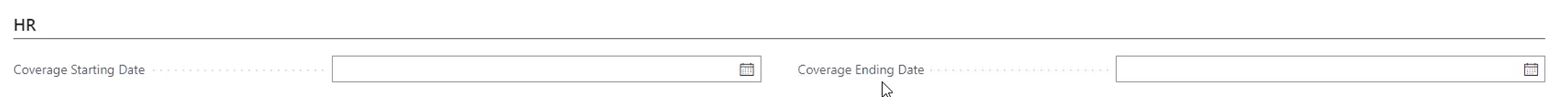

New HR Fields Section in Deduction Card

There is now an HR FastTab at the bottom of the deduction card with Coverage Starting Date and Coverage Ending Date fields.

These fields are currently for informational purposes and do not determine any calculations in payroll.

Error Message to Prevent Using Regular Earnings Subtype When Pulling Earnings From Hours Details

The ability to use the REGULAR earnings subtype with earnings coming from hours details is no longer allowed.

The following error message now appears when you use the REGULAR subtype on payroll earnings codes and the earnings are coming from hours details:

You can not set subtype to REGULAR while using Earnings from Hours Details

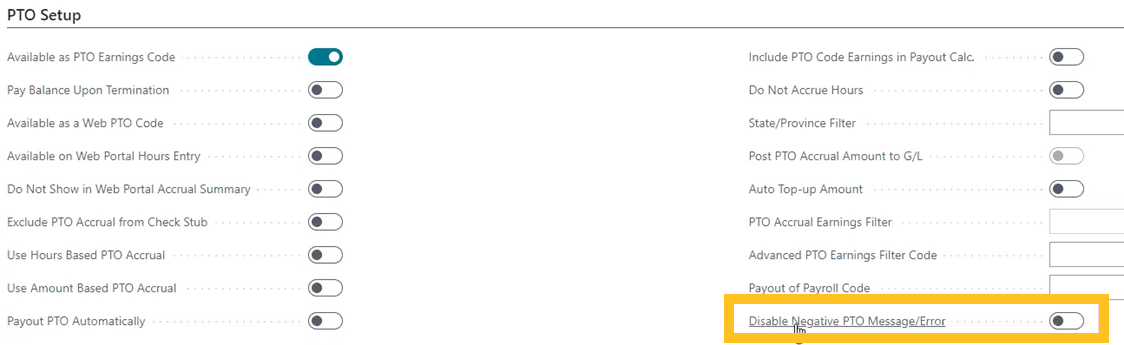

Disable Negative PTO Warning

There is now a checkbox on the PTO card to turn off the warning You are about to go negative on PTO hours. This field can be activated on the Payroll Code Setup Card page, on the PTO Setup FastTab.

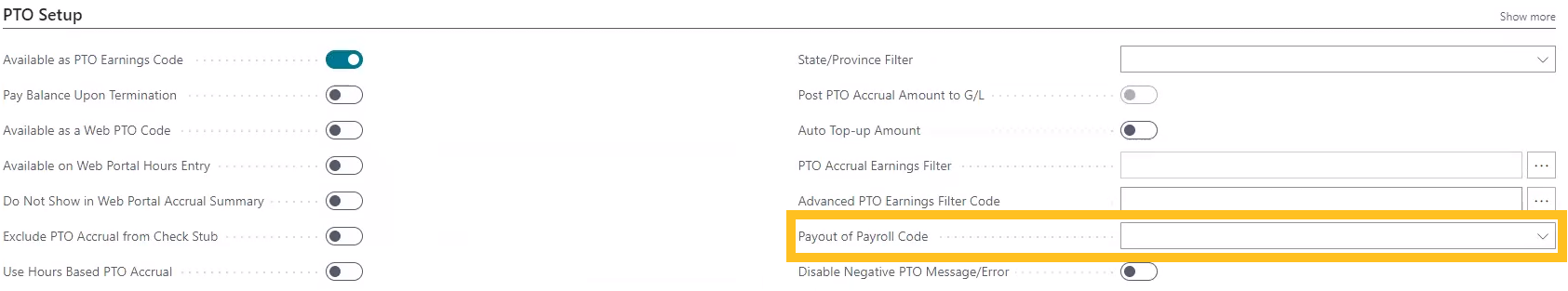

Payout of Payroll Code

On the Payroll Code Setup Card page, on the PTO Setup FastTab, there is a new Payout of Payroll Code field.

When a code is specified in the Payout of Payroll Code field and this code is used in a payroll document, Sparkrock Impact automatically creates usage PTO entries for the original accrual payroll code during the posting.

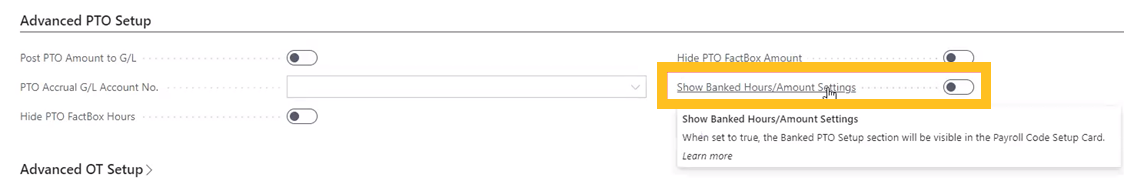

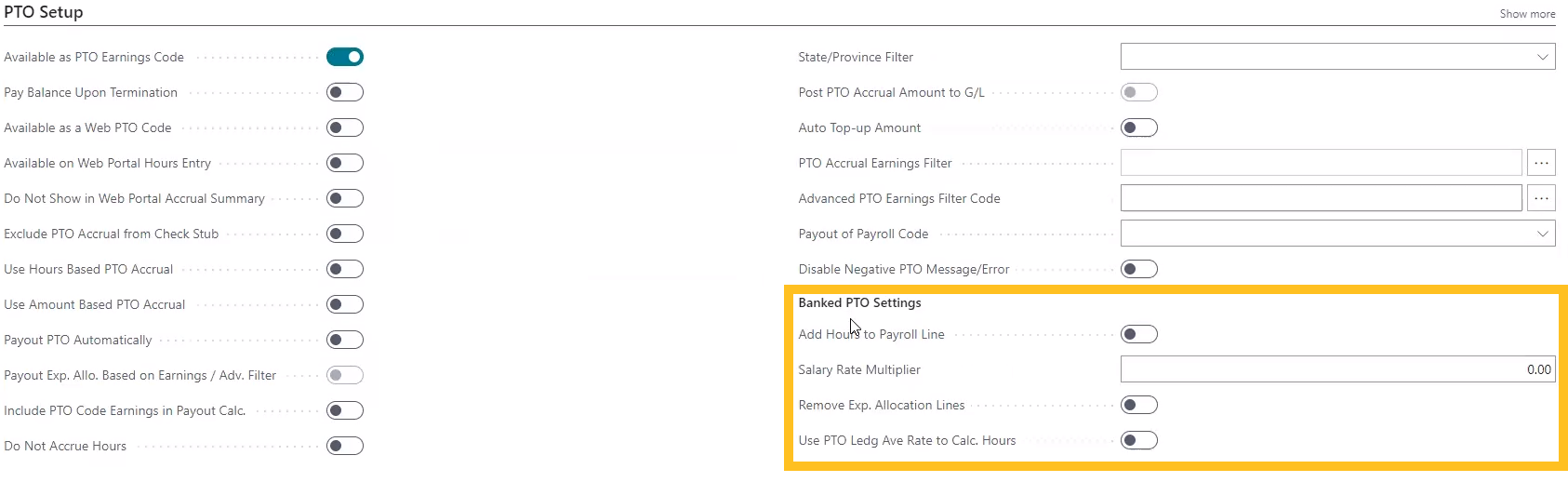

Show Banked Hours/Amount Settings

On the Additional Payroll Setup page, on the Advanced PTO Setup FastTab, there is a new Show Banked Hours/Amount Settings field. When Show Banked Hours/Amount Settings is turned on, the Banked PTO Settings section is visible on the Payroll Code Setup Card page, on the PTO Setup FastTab.

The following list describes the fields that are available in the Banked PTO Settings section:

Add Hours to Payroll Line: When turned on, hours are added to the payroll line using the employee salary rate multiplied by the multiplier.

Salary Rate Multiplier: Multiplier that is used against the employee salary rate to calculate the number of hours.

Remove Exp. Allocation Lines: When turned on, removes the associated expense allocation after adding the hours to the payroll line.

Use PTO Ledg Ave Rate to Calc. Hours: When turned on, Sparkrock Impact uses the PTO Ledger average rate to calculate the hours from the total amount paid out divided by the average PTO ledger rate. Sparkrock Impact finds the payroll code to filter on in the PTO ledger by finding the PTO accrual code that is linked to this PTO Payout code.

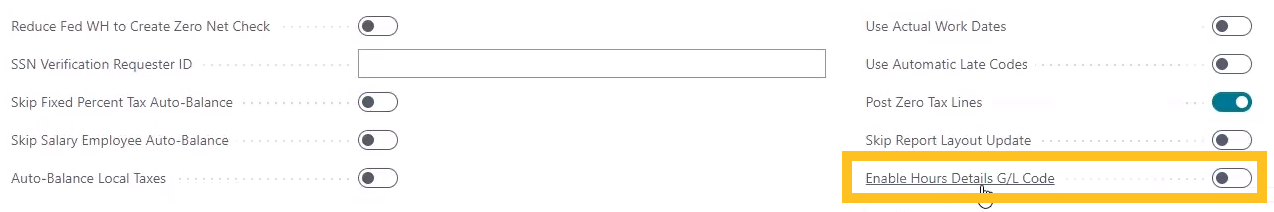

Enable Hours Details G/L Code

On the Additional Payroll Setup page, on the General FastTab, there is a new Enable Hours Details G/L Code field.

When Enable Hours Details G/L Code is turned on, if a G/L account code is loaded into hours details or the expense allocation lines, the code is used in posting the earnings.

This feature allows you to force the G/L code posting by putting the code in the hours details. If you load the G/L code in hours details, the code is posted to whatever G/L account is in hours details.

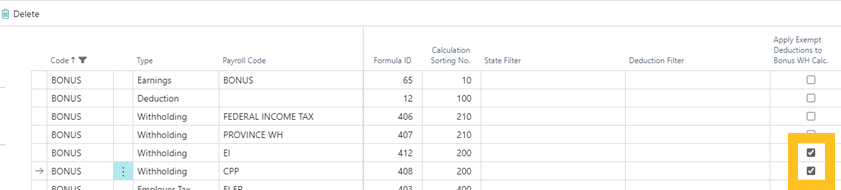

Apply Exempt Deductions to Bonus Withholding Calculation - Canada Only

For Canada only, on the Payroll Calculation Lines page, there is a new Apply Exempt Deductions to Bonus WH Calc. checkbox. When Apply Exempt Deductions to Bonus WH Calc. is selected, the tax exempt deductions are applied to the applicable earnings of bonus calculations.

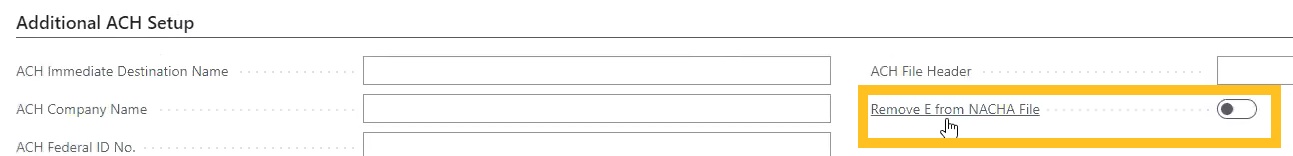

Remove E from NACHA File

On the Additional Payroll Setup page, on the Additional ACH Setup FastTab, there is a new Remove E from NACHA File field.

When Remove E from NACHA File is turned on, Sparkrock Impact removes the E from the NACHA file detail record.

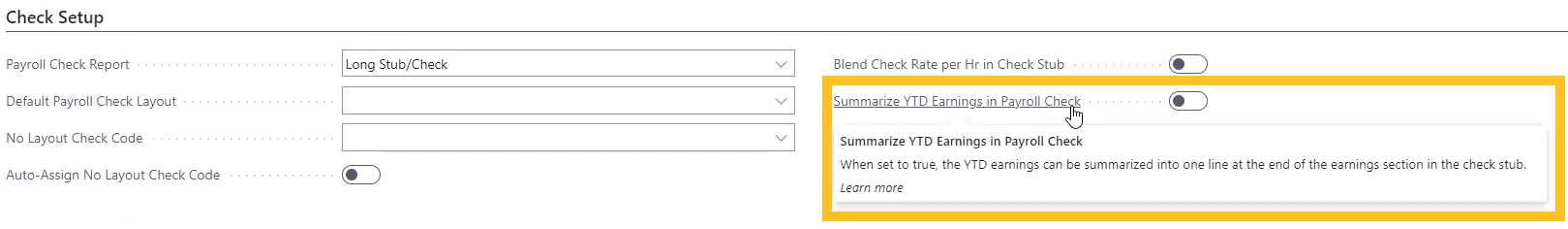

Summarize YTD Earnings in Payroll Check

On the Payroll Setup page, on the Check Setup FastTav, there is a new Summarize YTD Earnings in Payroll Check field.

When Summarize YTD Earnings in Payroll Check is turned on, the YTD earnings can be summarized into one line at the end of the earnings section in the check stub.

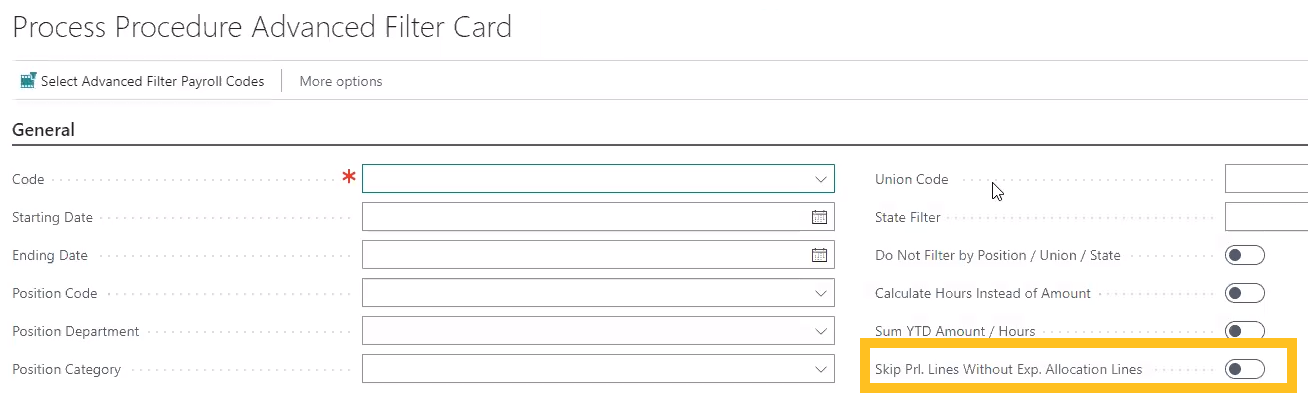

Skip Payroll Lines Without Expense Allocation Lines

On the Process Procedure Advanced Filter Card page, there is a new Skip Prl. Lines Without Exp. Allocation Lines field.

When Skip Prl. Lines Without Exp. Allocation Lines is turned on, when the payroll lines do not have associated expense allocation lines, Sparkrock Impact skips the lines.

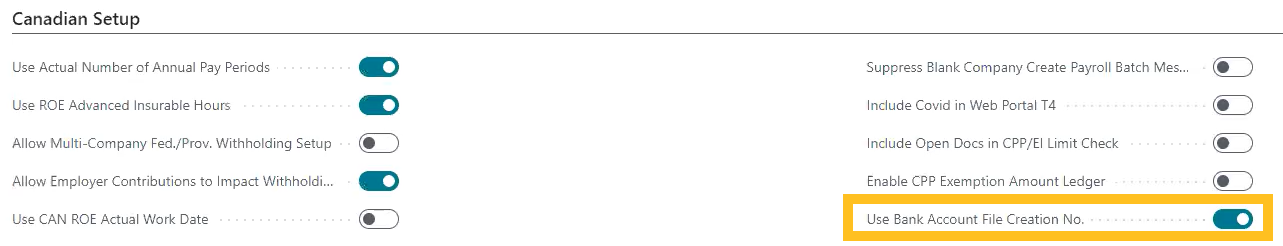

Use Bank Account File Creation No.

On the Additional Payroll Setup page, on the Canadian Setup FastTab, there is a Use Bank Account File Creation No. field.

When Use Bank Account File Creation No. is turned on, Sparkrock Impact inputs the last E-Pay file creation number of the bank account in the EFT file, instead of the value of EFT File Creation No from the Payroll Setup page.

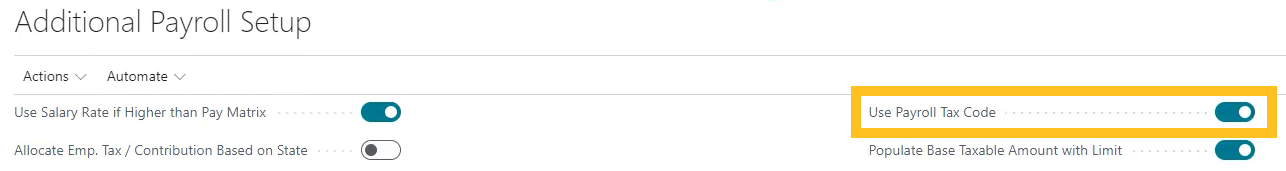

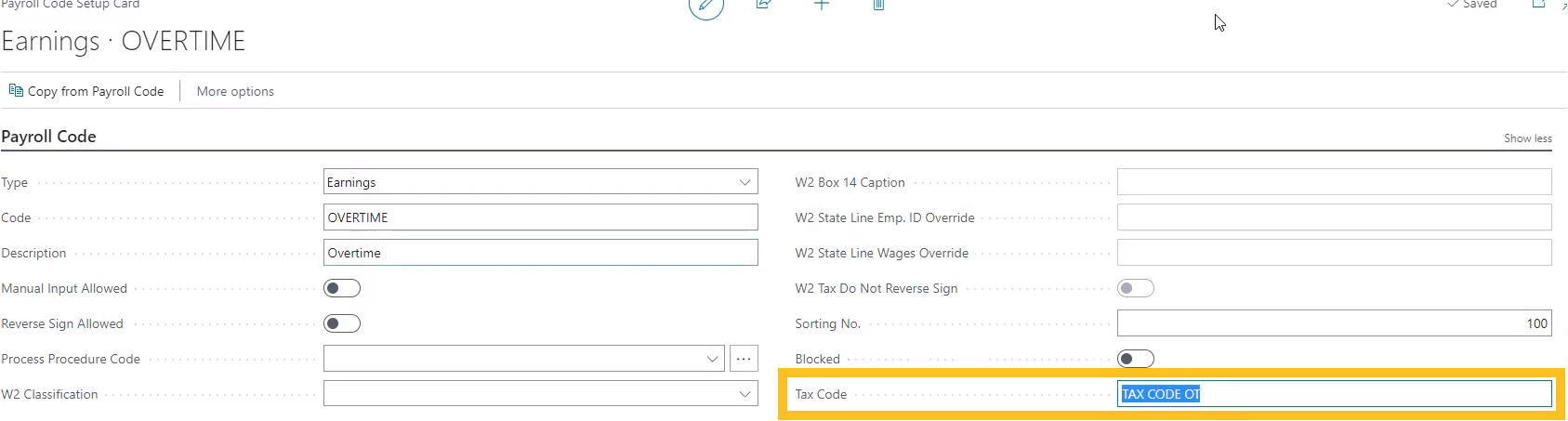

Use Payroll Tax Code

On the Additional Payroll Setup page, on the General FastTab, there is a new Use Payroll Tax Code field.

When Use Payroll Tax Code is turned on, on the Payroll Code Setup Card page, a Tax Code field appears. Sparkrock Impact populates the tax code that is specified in the Tax Code field in the payroll ledger.

This feature allows codes to be set up and linked to the payroll codes, primarily for mapping to the necessary electronic filing codes.

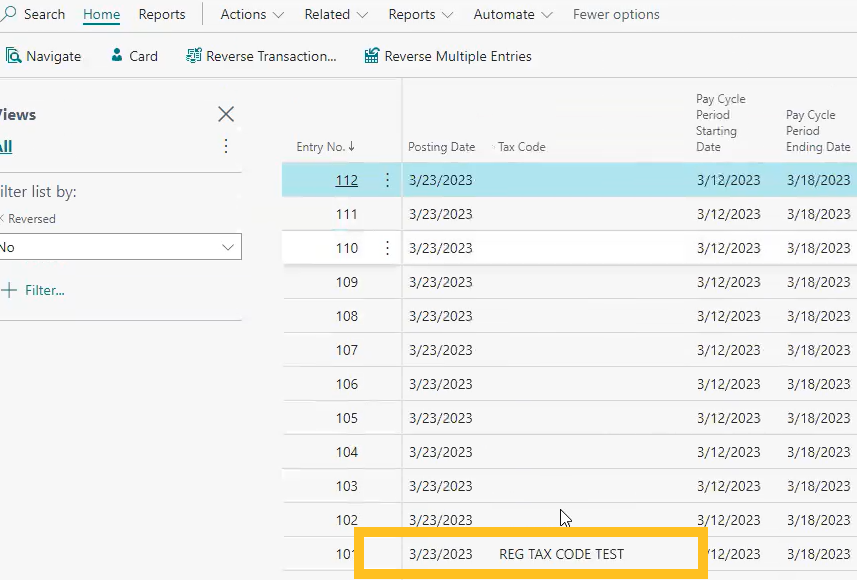

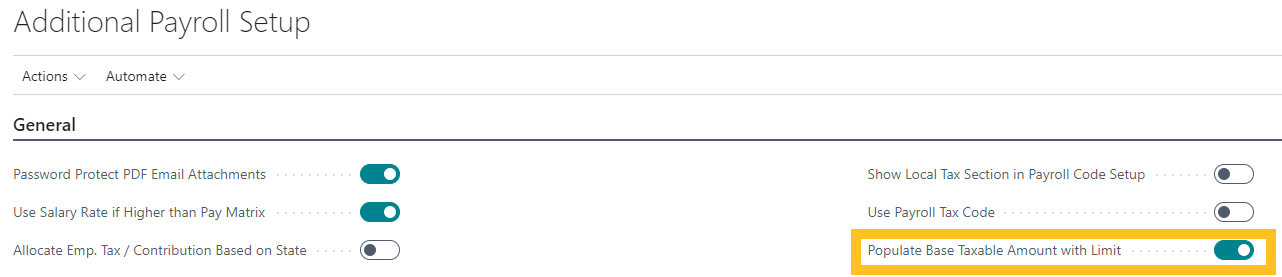

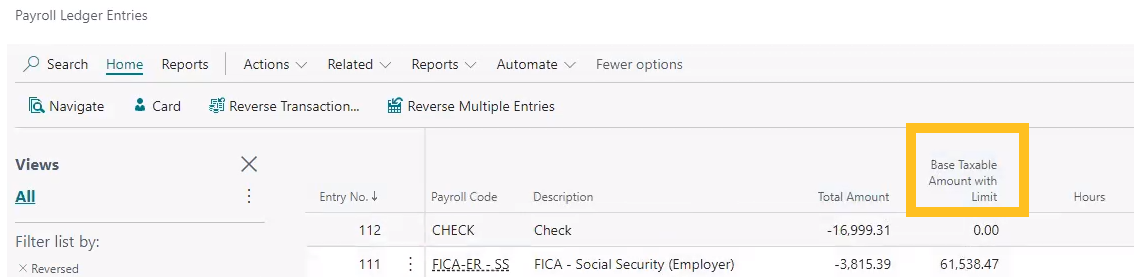

Base Taxable Amount With Limit

On the Additional Payroll Setup page, when Populated Base Taxable Amount with Limit is turned on, on the Payroll Ledger Entries page, there is a new Base Taxable Amount with Limit field. When Populated Base Taxable Amount with Limit is turned on, Sparkrock Impact automatically populates the Base Taxable Amount with Limit field.

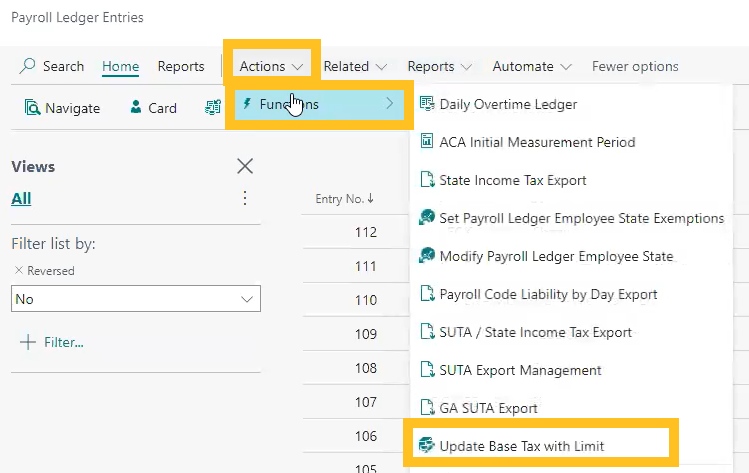

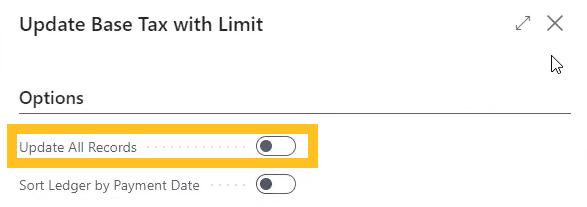

To populate data in the Base Taxable Amount with Limit field from the beginning of the year, on the action bar, choose Actions > Functions > Update Base Tax with Limit, turn on Update All Records, and then choose OK.

Currently, this capability is only available for social security. FUTA and SUTA will be available in a future release, along with state specific payroll taxes that have limits.

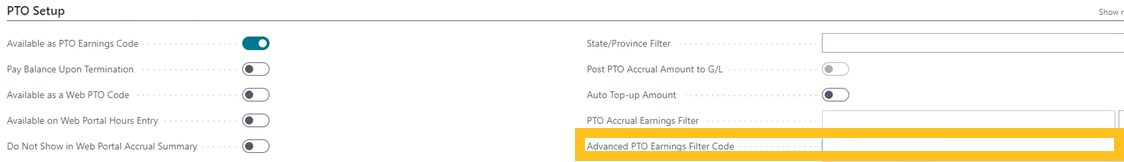

Advanced PTO Earnings Filter Code

On the Payroll Code Setup Card page, there is a new Advanced PTO Earnings Filter Code field.

Due to the number of hours that go into the accrual having to be filtered, sometimes this allows a user to pick an advanced filter code to calculate the amount of base PTO hours that are to go into the PTO accrual calculation. This code is necessary so that Sparkrock Impact can filter on hours that are only in a certain state, union, position, and so on.

Related information

Feedback

To send feedback about this page, select the following link: