Payroll release notes version 21.26.0.0, 21.27.0.0, 21.28.0.0, and 21.29.0.0

These release notes include supplemental information about the payroll release versions 21.26.0.0, 21.27.0.0, 21.28.0.0, and 21.29.0.0.

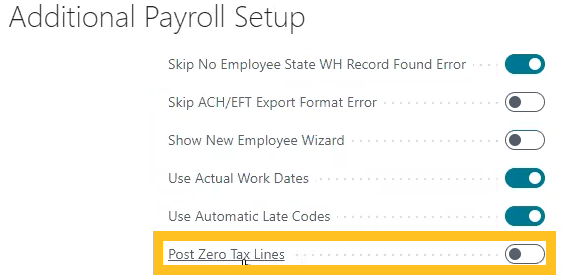

Post Zero Tax Lines

When Post Zero Tax Lines is turned on, all withholdings and employer taxes are posted to the payroll ledger even when the tax amount is zero.

Sparkrock Impact calculates payroll lines, and then posts the lines to the payroll ledger even when there is no tax necessary, for example, tax exemptions and surpassing wage limit thresholds.

This feature is helpful for managing base taxable amount calculations.

Tip

Tip:

To view the Post Zero Tax Lines field, perform the following steps:

- Select Search (Alt+Q)

, enter payroll setup, and then choose the related link.

The Payroll Setup page opens.

, enter payroll setup, and then choose the related link.

The Payroll Setup page opens. - On the action bar, choose Additional Setup. The Additional Payroll Setup page opens. The Post Zero Tax Lines field is available on the General FastTab.

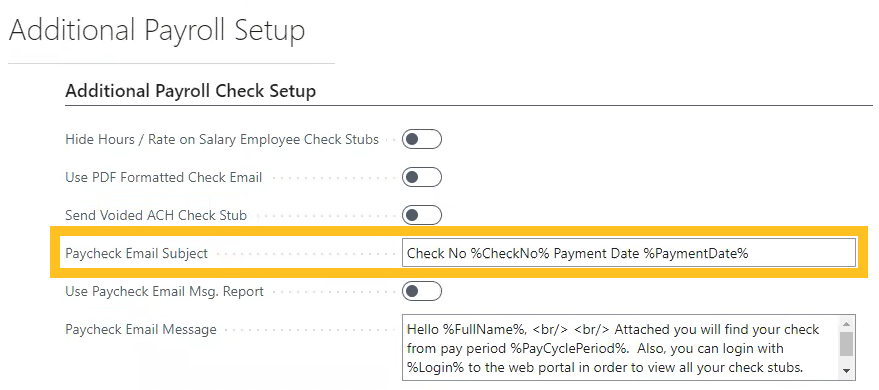

Paycheck Email Subject

The Paycheck Email Subject field provides the capability for a user to specify captions and variables that include payroll data, and then have Sparkrock Impact insert this information into the paycheck email subject as desired.

Note

Note:

The % symbol must surround each caption.

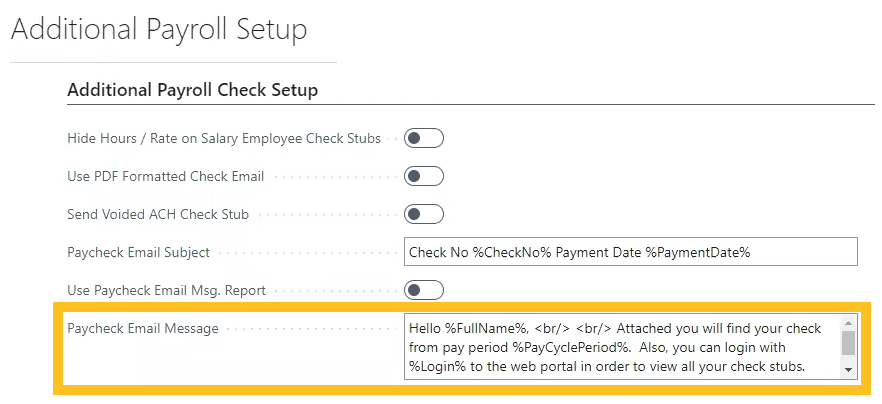

Paycheck Email Message

The Paycheck Email Message field provides the capability for a user to specify captions and variables that include payroll data, and then have Sparkrock Impact insert this information into the paycheck email message as desired.

Note

Note:

The % symbol must surround each caption.

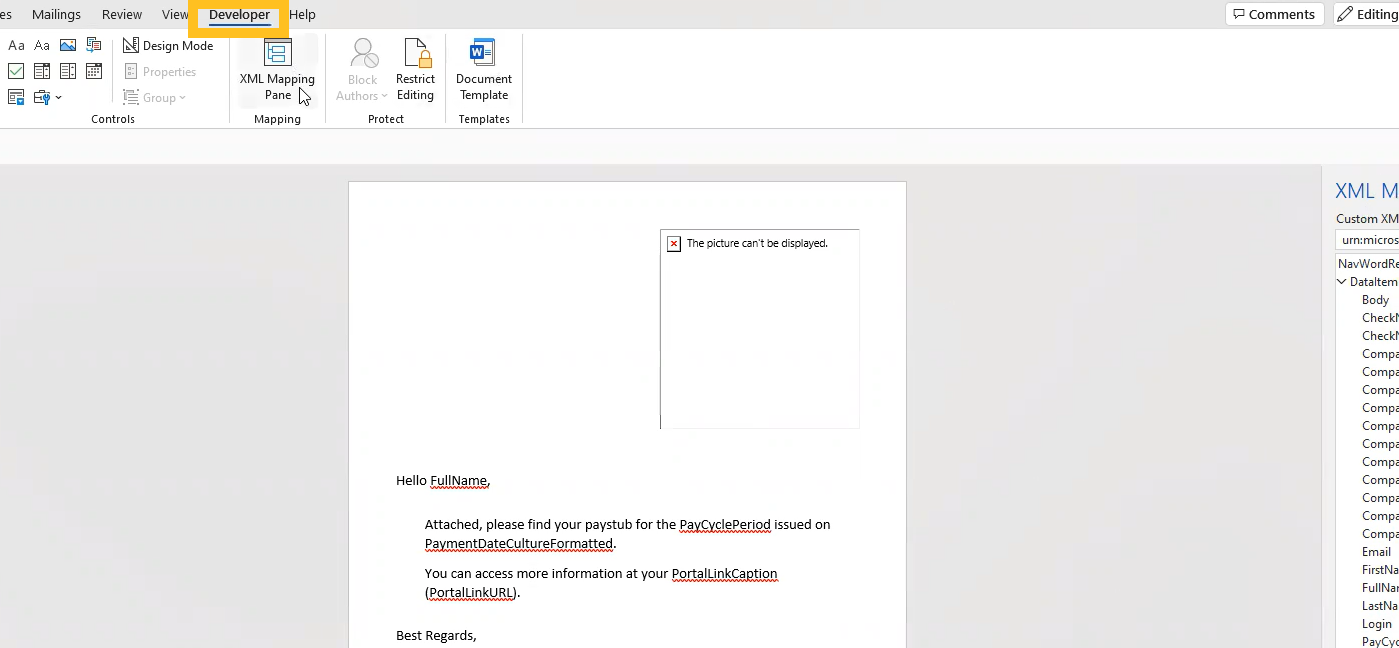

Variable Commands for Paycheck Email Subject and Paycheck Email Message

The following list includes some examples of variable commands that you can specify in the Paycheck Email Subject and Paycheck Email Message fields:

'%First%', PayrollEmployee."First Name"

'%Last%', PayrollEmployee."Last Name"

'%FullName%', PayrollEmployee."Full Name"

'%Email%', PayrollEmployee."E-Mail"

'%Login%', PayrollEmployee.Login

'%PaymentDate%', Format "Payment Date", 0, '<Month,2>-<Day,2>-<Year4>'

'%PayCyclePeriod%', "Pay Cycle Period"

'%CheckName%', CheckName

'%CheckNo%', "Check No."

'%CompanyName%', CompanyInformation.Name

'%CompanyPhone%', CompanyInformation."Phone No."

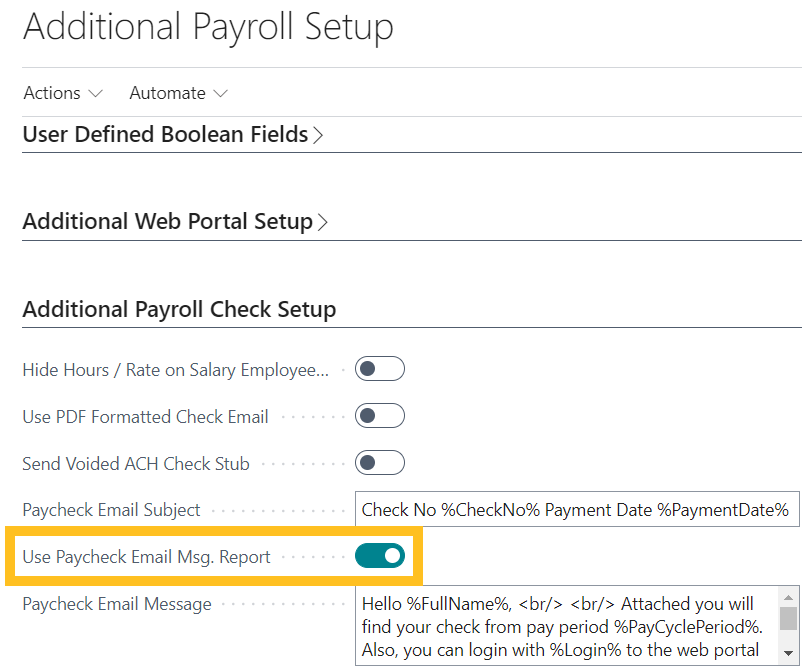

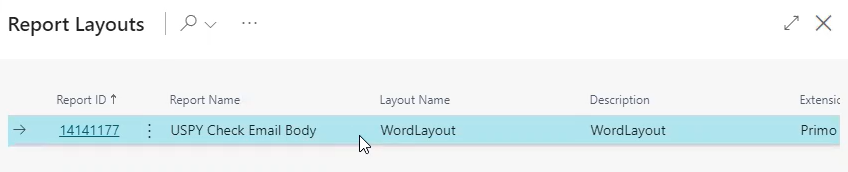

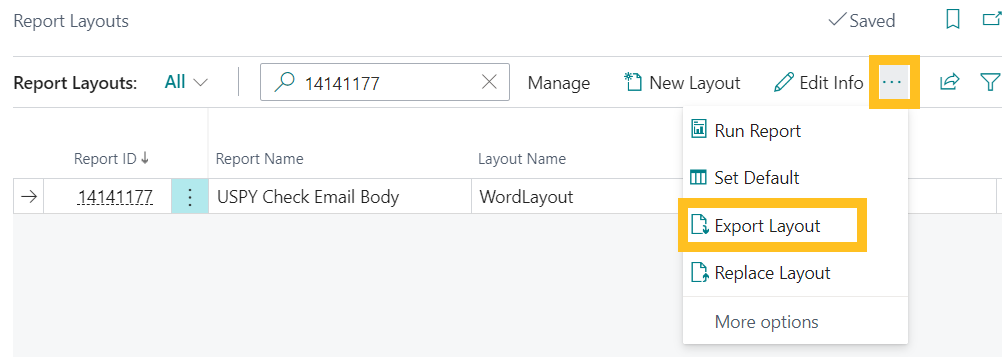

Use Paycheck Email Msg. Report

When Use Paycheck Email Msg. Report is turned on and you want to change the email body, you can export the layout to a Microsoft Word file, and then modify the contents of the file as desired.

Note

Note:

In Microsoft Word, to access the XML Mapping pane where you modify the file contents, you must add or open the Developer tab.

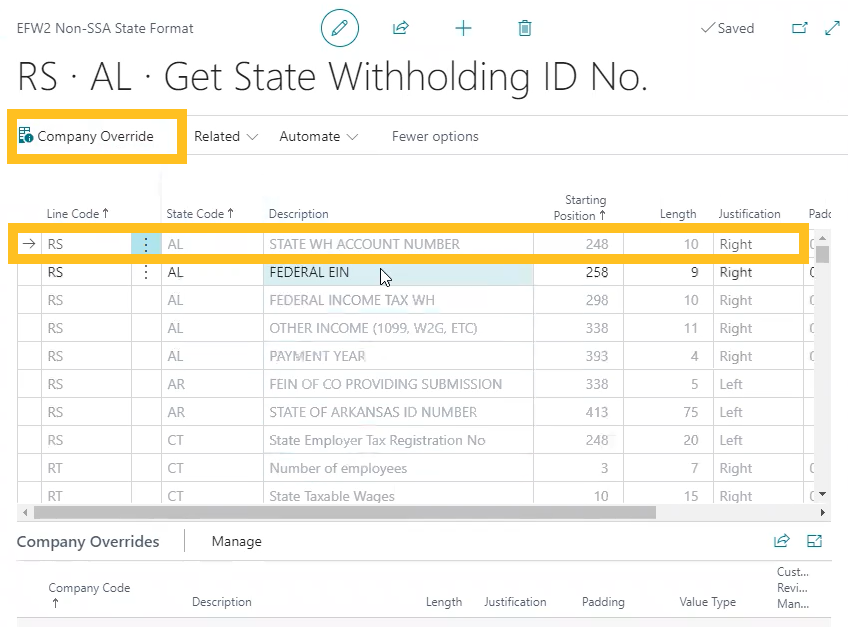

SUTA/EFW2 Company Override

The new Company Override page provides the capability for users to add a company override on specific fields in the setup for SUTA and W2 exports. This feature provides the necessary functionality to replace a few data points in a SUTA or W2 export while allowing other data points in the export to remain as is. Instead of having to set up all lines for every company, you can now override only the fields that change by company.

Note

Note:

On the Payroll Setup page, you must have Use Multi-Company turned on.

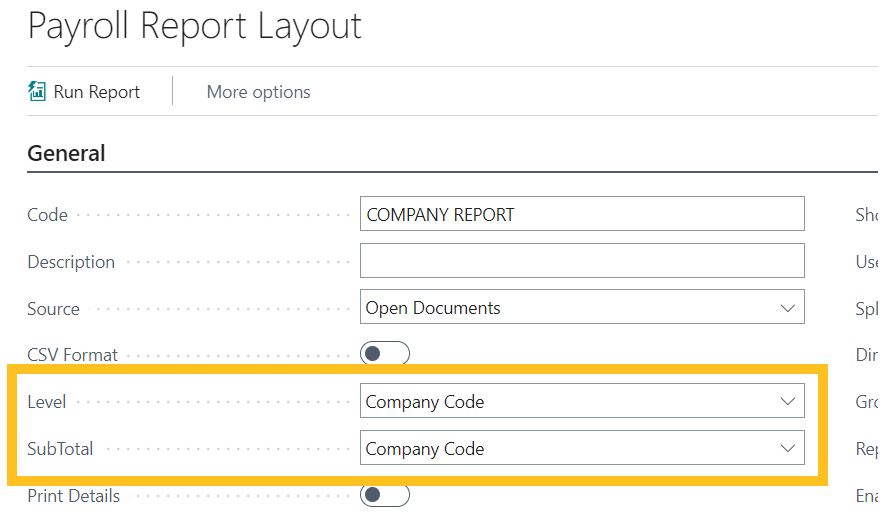

Company Code option added for SubTotal and Level fields on the Payroll Report Layout page

On the Payroll Report Layout page, in the Level and SubTotal fields, you can now specify the value of Company Code. This feature provides the capability to have the payroll report output grouped by company code.

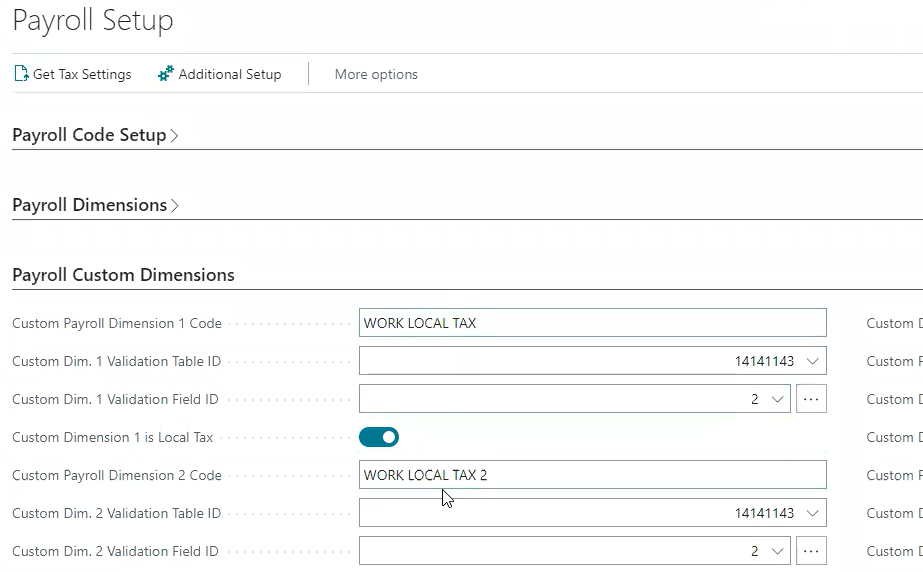

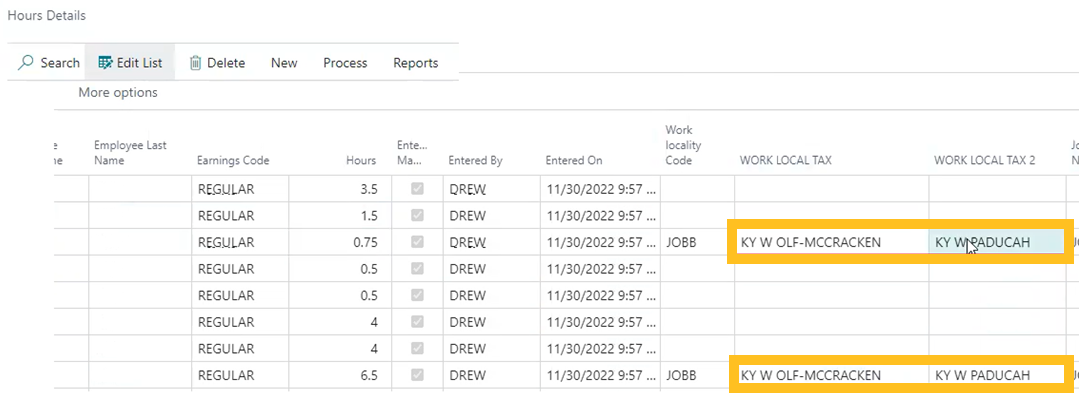

Auto Local Tax Updates – Multiple Local Taxes

The feature allows custom payroll dimensions to be set as local tax codes.

You can now have a work locality that is not the same for the entire pay period.

Example

The following image displays a custom payroll dimension on the Payroll Setup page.

The following image displays the Hours Details page and shows how those custom payroll dimensions can track the variance in the local tax settings for the cycle.

Related information

Feedback

To send feedback about this page, select the following link: