Payroll release notes version 19.20.0.0

These release notes include supplemental information about the payroll release version 19.20.0.0.

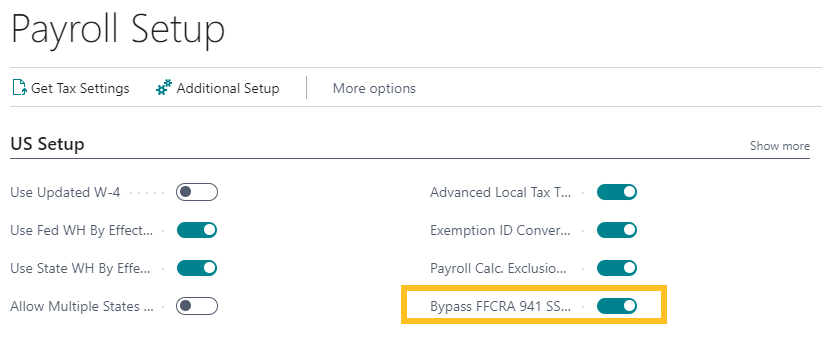

Bypass FFCRA 941 SS ER calculations

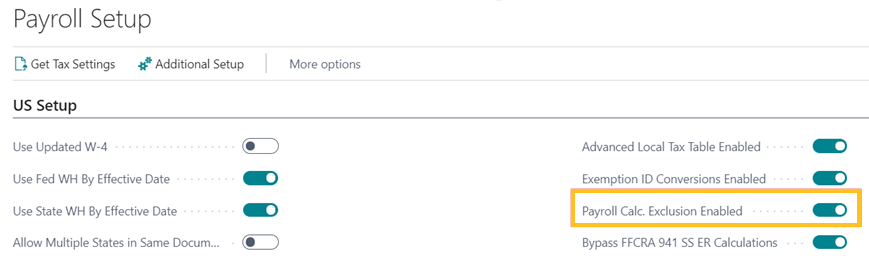

On the Payroll Setup page, this release automatically turns on Bypass FFCRA 941 SS ER Calculations.

In Q2 2021, the FFCRA credit was changed from SS ER to Med ER. The credit was moved from the top portion of the 941 to the bottom section to be taken as an adjustment. Therefore, the Med ER credit does not need to be reflected in the payroll ledger entries.

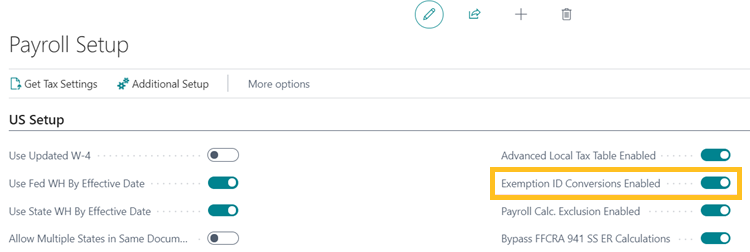

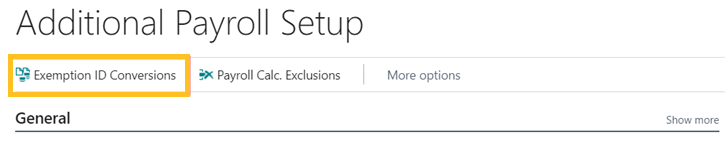

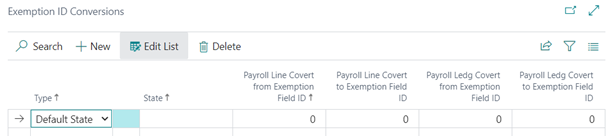

Exemption ID conversions

On the Payroll Setup page, when you turn on Exemption ID Conversions Enabled, you can access the new Exemption ID Conversions page. This feature provides the capability to change the exemption field number for designated states and allows the user to have exceptions for designated state exemptions for states that treat taxable wages differently than others, for example, the 410K treatment in PA.

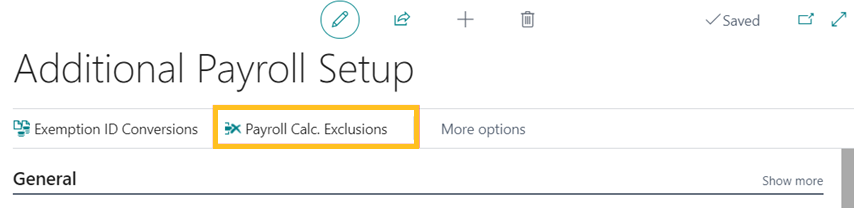

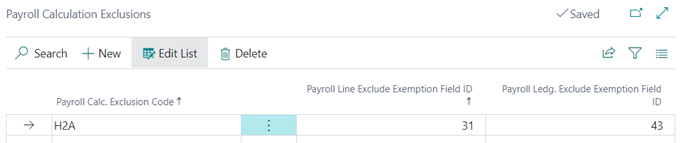

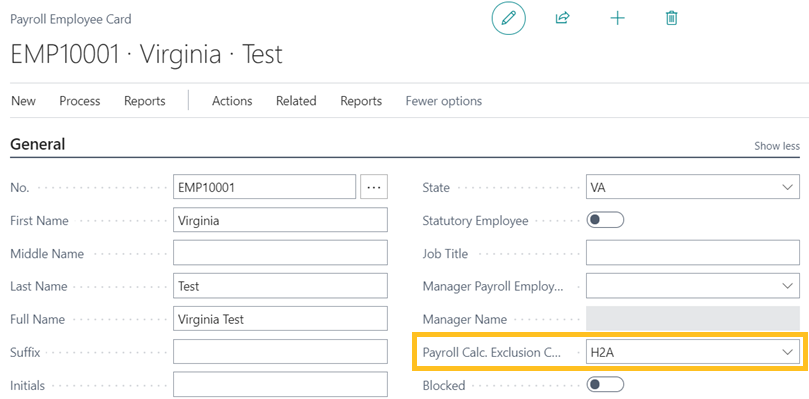

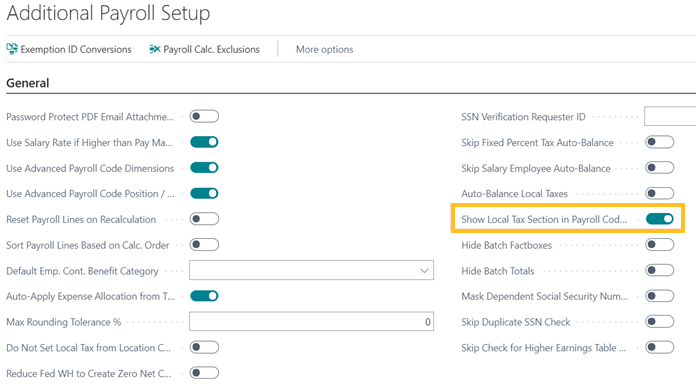

Payroll calculation exclusion

This functionality allows you to setup certain types of taxes to be completely excluded, such as wages, withholding tax, and employer tax, from the employees that have this exclusion code. For example, if you select exempt from social security, the employees with this exclusion code do not show applicable wages or withholding tax in their payroll document or in the tax reports, such as W2, and 941.

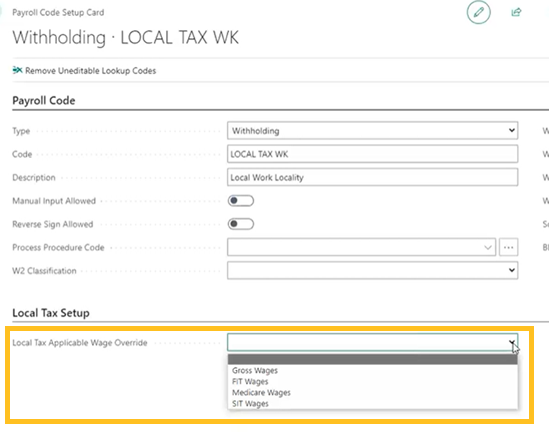

Local tax applicable wage override

This feature provides the capability to determine what wages are applicable to the local tax at the local tax payroll withholding code level. Therefore, you can have different local tax withholding codes use different wage bases.

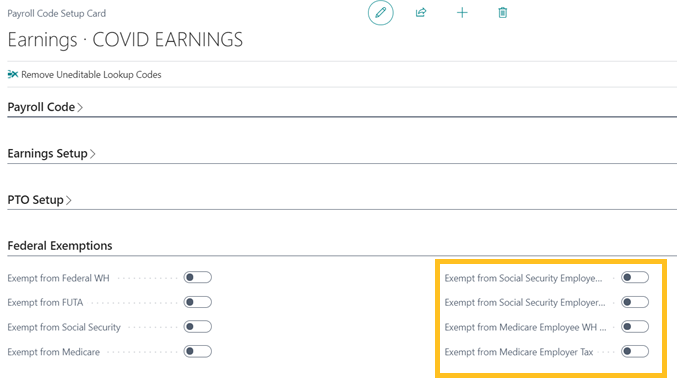

COVID earnings setting update

In Q2 2021, the IRS made changes to how qualified COVID earnings exemptions are calculated. Ensure that COVID earnings are no longer set to be exempt from SS EE, SS ER, MED EE, or MED ER on the Federal Exemptions FastTab of the COVID Earnings Payroll Code Setup Card page. It is recommended that the credit not be part of the payroll lines or ledger anymore as the credit is now taken towards the bottom of the 941 as an adjustment.

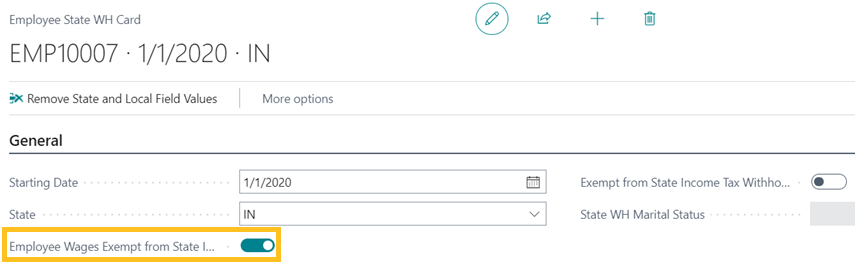

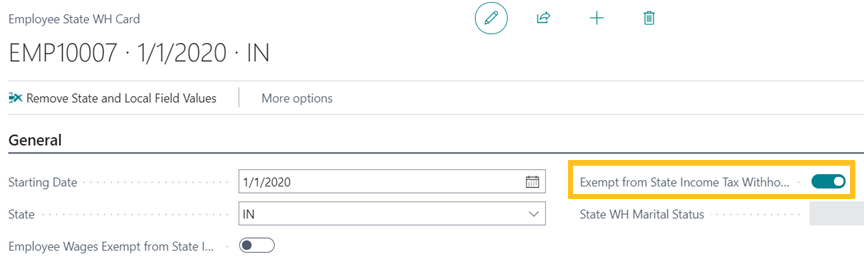

Employee wages exempt from state income tax

On the Employee State WH Card page, when Employee Wages Exempt from State Income Tax is turned on, any earnings in that state are exempted from showing the earnings as applicable to the state. This in turn leads to 0 earnings in that state and therefore 0 withholdings.

Warning

Warning:

If Employee Wages Exempt from State Income Tax is turned on, the W2 and quarterly reports show no earnings applicable to this state.

Exempt from state income tax withholding

On the Employee State WH Card page, when Exempt from State Income Tax Withholding is turned on, there no income tax withholding is calculated for this state, however the earnings show as applicable earnings in the state income tax reports and W2.

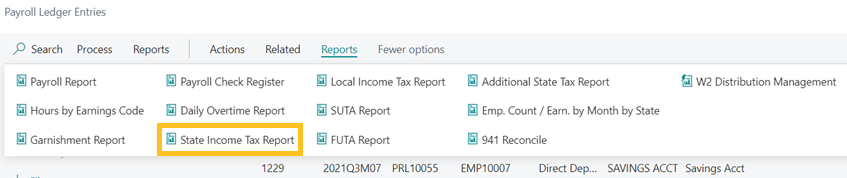

State income tax report reminder

The State Income Tax Report shows the wages that are going to be displayed on the W2. This functionality provides the capability for users to check employees and see whether anyone has 0 wages in a state where they are expected to have wages.

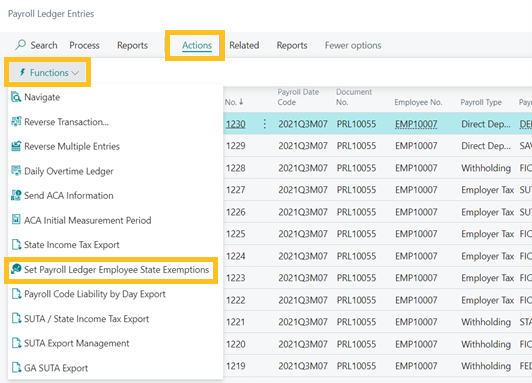

Set payroll ledger employee state exemptions

This feature provides the capability to change the exemption settings of employees on the Payroll Ledger Entries page. If a user runs the State Income Tax Report and notices certain employees have the wrong state exemption settings, this report provides the capability to filter the employees and adjust their settings.

State update options

You can now reset the employee state exemption setting in the payroll ledger.

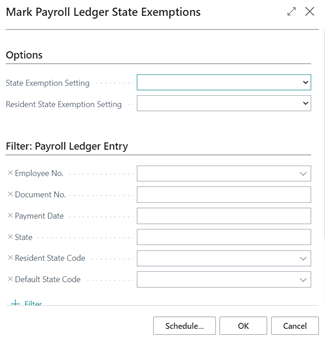

To set an employee's wages to be applicable state wages

On the Mark Payroll Ledger State Exemptions page, filter on the employee number.

Specify the date range.

The range is most likely all of 2021.

Set the State Exemption Setting to No, the Resident State Exemption Setting to No, or both to No.

Choose Ok.

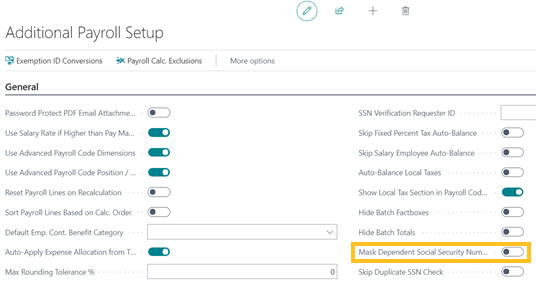

Mask dependent Social Security Numbers

On the Additional Payroll Setup page, when Mask Dependent Social Security Numbers is turned on, the dependents Social Security Numbers are masked.

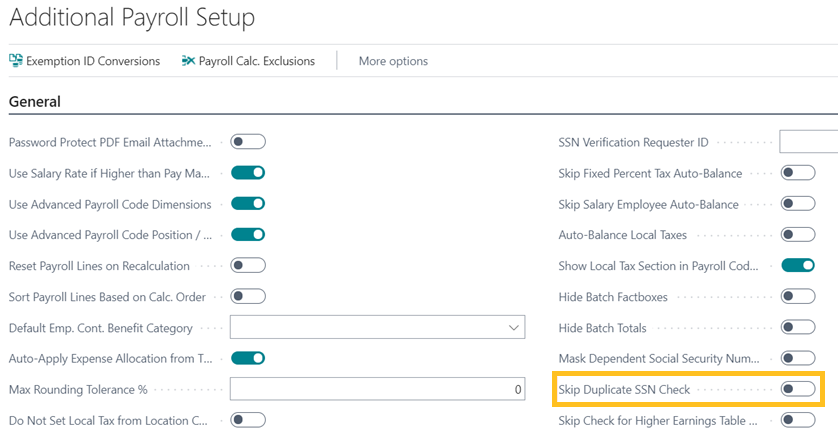

Skip duplicate SSN check

When Skip Duplicate SSN Check is turned on, payroll skips the duplicate SSN check.

Caution

Caution:

This functionality speeds up the process of loading a new SSN, but also increases the risk of loading a duplicate SSN.

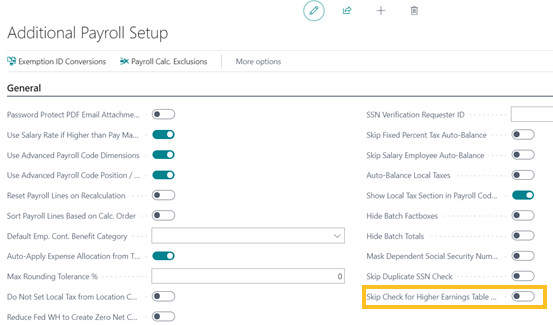

Skip check for higher earnings table rate

When Skip Check for Higher Earnings Table is turned on, if an earnings rate is found specific to a payroll employee number, that rate is used even if the rate is not higher than the employee's salary rate. This functionality is only applicable when the value type is fixed hourly / piece rate.

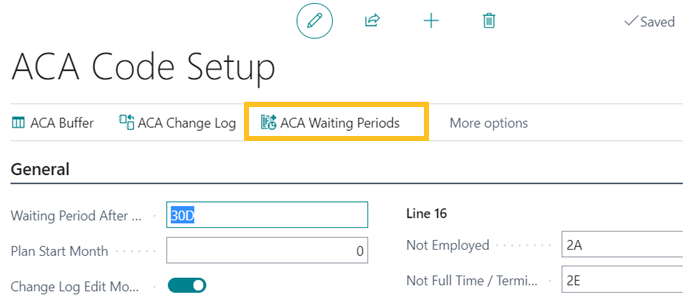

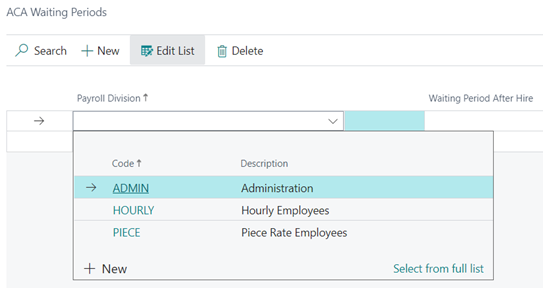

ACA waiting periods

This feature provides the capability for a user to setup different ACA waiting periods by payroll division.

On the ACA Code Setup page, on the General FastTab, the Waiting Period After Hire is the default waiting period unless new waiting periods are set up on the ACA Waiting Periods page.

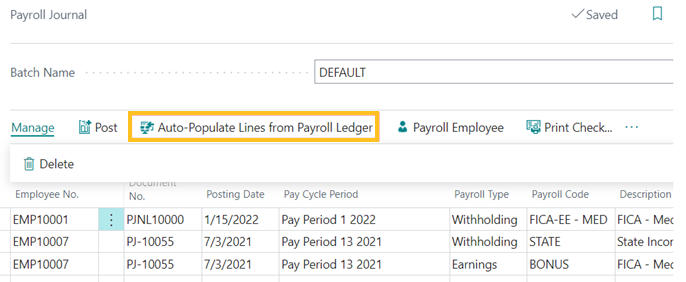

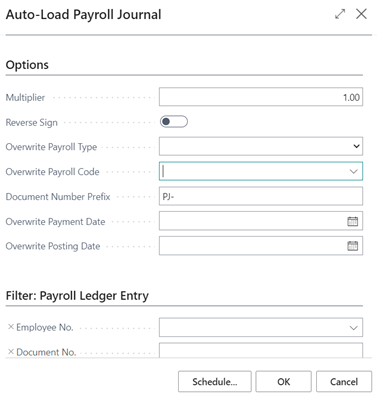

Automatically populate lines from payroll ledger

This new functionality simplifies the process of loading payroll journals. The payroll journal can be automatically loaded from the payroll ledger. Multiple entries can be loaded at once and the amount that's found in the ledger can be multiplied by a particular number. Also, the sign can be reversed and so on.

Related information

Feedback

To send feedback about this page, select the following link: