Payroll release notes version 17.13.0.0

These release notes include supplemental information about the payroll release version 17.13.0.0.

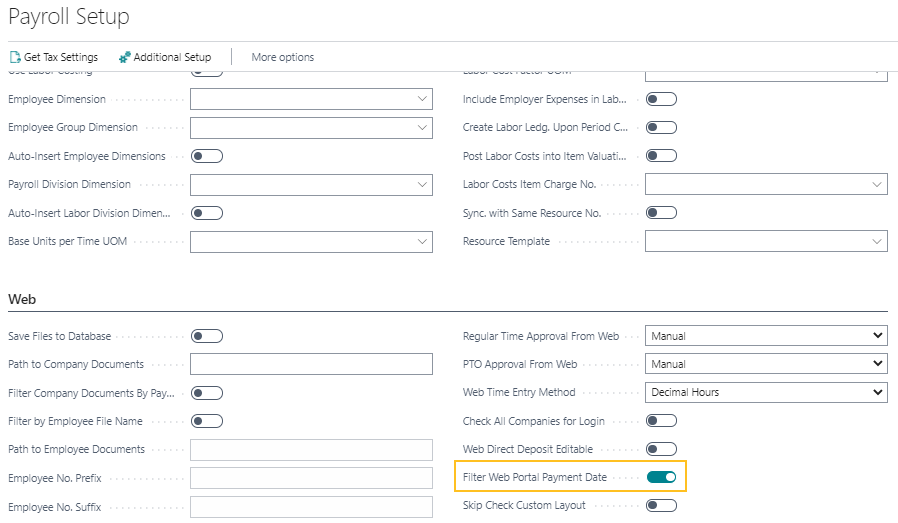

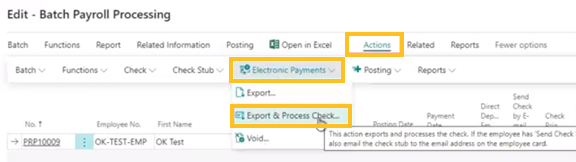

Filter Web Portal Payment Date

On the Payroll Setup page, if Filter Web Portal Payment Date is turned on, the posted payroll check stubs on the employee self-service portal are filtered by the current date (today's date). Anything posted with a payment date after the current date, do not show until the payment date is on or before the current date.

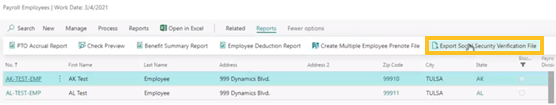

SSA User ID

An export for Social Security Verification is now available.

The verification requires a Requester ID that can be entered in Payroll Setup so the user does not have to enter it every time you run this report. Also, to easily filter the new employees, the user can filter by Hire Date.

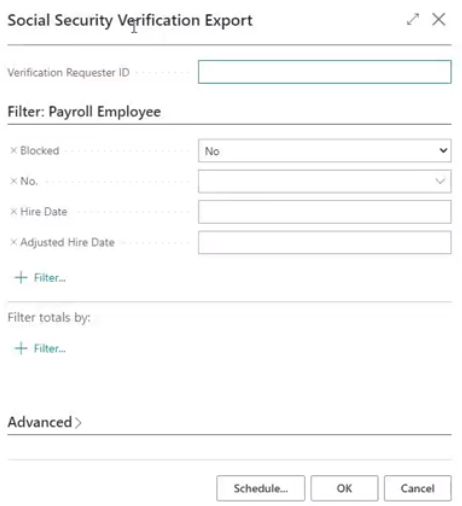

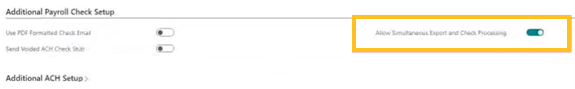

Export & Process Check

The Export & Process Check action exports and processes a check. If the employee has on the employee card, Send Check Stub by E-mail turned on, this action also emails the check stub to the email address on the employee card. The batch can then be posted without having to print anything, which can save considerable time.

This feature can be enabled on the Additional Payroll Setup page. When Allow Simultaneous Export and Check Processing is turned on, the Export &; Process Check Processing action becomes visible in the batch payroll and payroll processing pages.

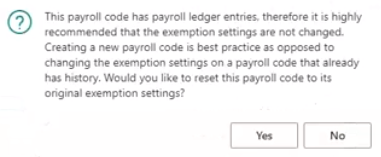

Payroll code exemption settings warning

If you attempt to adjust the exemption settings on a deduction code that already has posted entries, the following warning message appears:

If the user chooses Yes, the code reverts back to its original exemption settings.

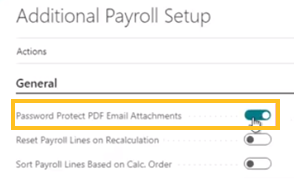

Password protect PDF email attachments

Now there is an event if the partner or end user wants the password for PDF email attachments to be something other than the social security number without dashes, which is the standard password.

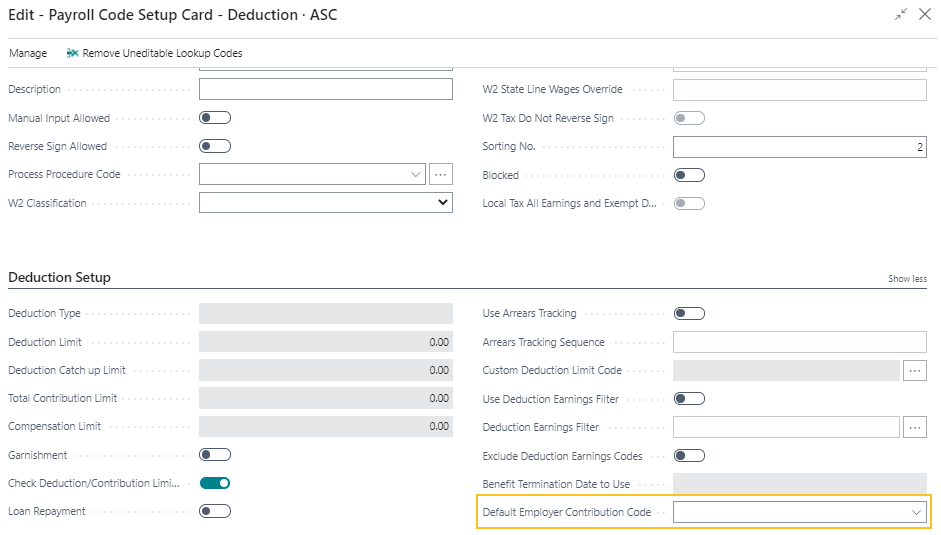

Default Employer Contribution Code

With this feature, you can link a Default Employer Contribution Code to a deduction card, for example, a 401k deduction code. Then the deduction code automatically includes the employer contribution setup when you apply that deduction code with the Default Employer Contribution Code to an employee's deduction card.

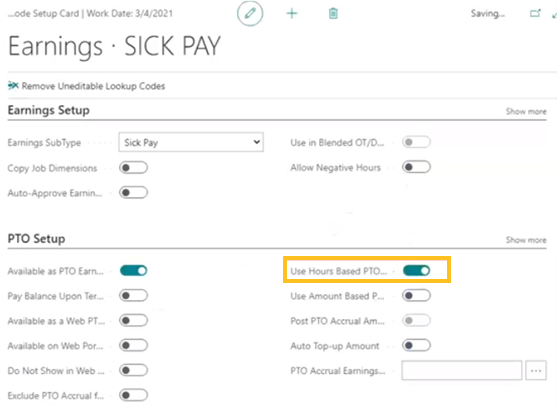

PTO setup increased decimal places

This new feature increased decimals in the PTO hours accrual setup to include 5 decimal places.

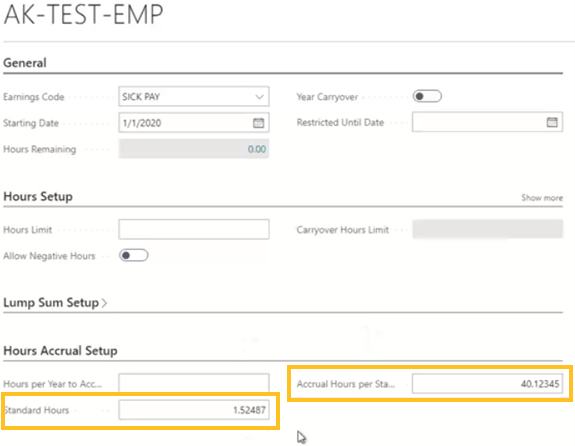

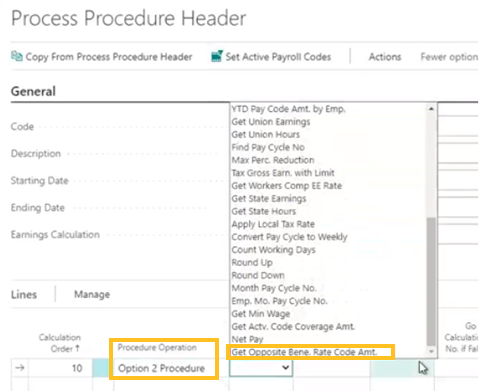

New State ID field

Form W2 State ID now has its own box. If it is populated, this new state ID field is the number that shows in the printed W2 form box 15. The numbers in this field take precedence over any other ID number that shows up on the W2 form.

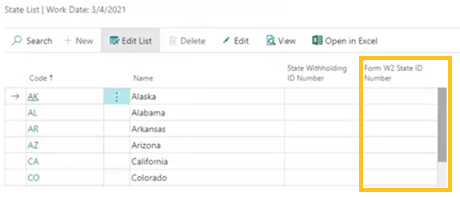

Get opposite benefit rate code amount process procedure

This functionality will find the appropriate deduction or employer contribution based on the benefit status code that is linked to the employee's deduction card and the amounts in the benefit rate details. This functionality pulls the opposite of the payroll code that is being processed, for example, if the payroll code is a deduction, the amount that is linked to the employer contribution is pulled in and vice versa.

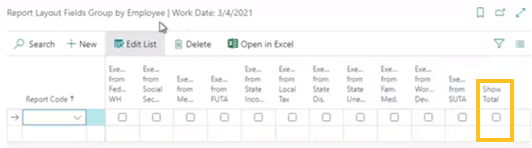

Show Total in field selection report

When Show Total is selected, the Field Selection Report displays totals at the bottom.

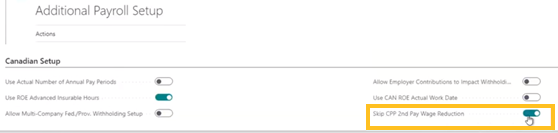

Skip CPP 2nd Pay Wage Reduction

When Skip CPP 2nd Pay Wage Reduction is turned on, if an employee is paid two times in the same pay cycle period, the CPP wage deduction is not applied on the 2nd pay.

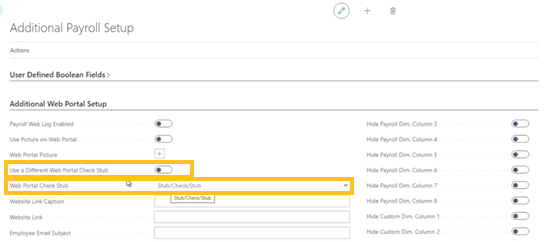

Web Portal Check Stub

You can now define a check stub specifically for the web portal.

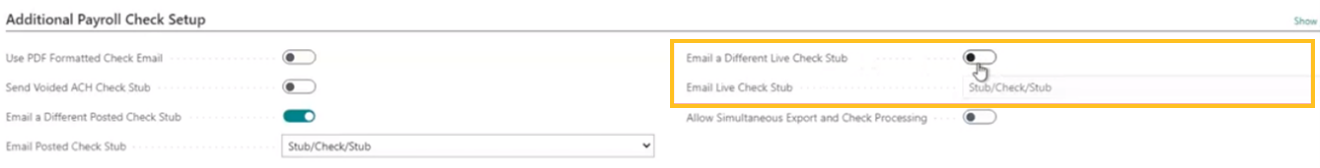

Email Live Check Stub

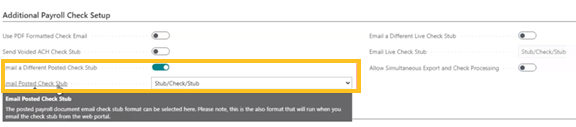

On the Additional Payroll Setup page, on the Additional Payroll Check Setup FastTab, when Email Live Check Stub is turned on, you can select a different check stub to email than the check stub that actually prints.

Email Posted Check Stub

On the Additional Payroll Setup page, on the Additional Payroll Check Setup FastTab, in Email Posted Check Stub, you can specify the posted payroll document email check stub format.

Note

Note:

This format is used when you email the check stub from the web portal.

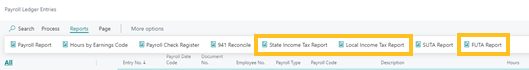

New State Income Tax Report, Local Income Tax Report, and FUTA Report

The new State Income Tax Report, Local Income Tax Report, and FUTA Report are accessible from the Payroll Ledger Entries page. These reports streamline reporting for users with multiple states, localities, or both. The new FUTA Report is similar to the SUTA Report, but is for FUTA.

Related information

Feedback

To send feedback about this page, select the following link: