Payroll release notes version 16.7.0.0

These release notes include supplemental information about the payroll release version 16.7.0.0.

There are new features in 16.7.0.0 related to Covid 19 FFCRA earnings / tax compliance and tips functionality.

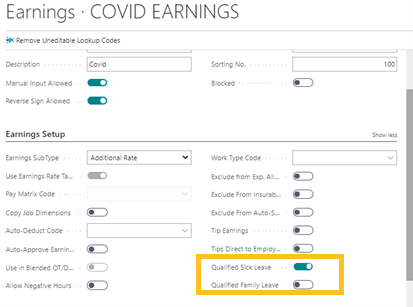

Qualified Sick Leave and Qualified Family Leave earnings code settings

Do not turn on both the Qualified Sick Leave and Qualified Family Leave settings on the same payroll code. Separate payroll codes are required because these amounts are separated on the 941.

When both these fields are turned on, taxes are calculated differently and the wages are on lines 5a(i) and 5a(ii) of the updated Q2 941 report.

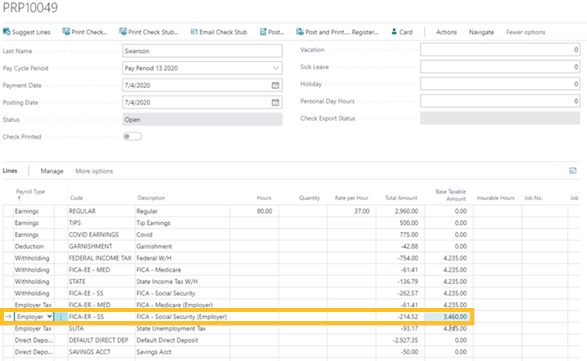

For example, with FFCRA Qualified Earnings, the Social Security ER wage base is reduced by the amount of Qualified Earnings in a payroll document because the Qualified Earnings are exempt from FICA Employer Social Security. However, these amounts are not exempt from the Employer side of Medicare.

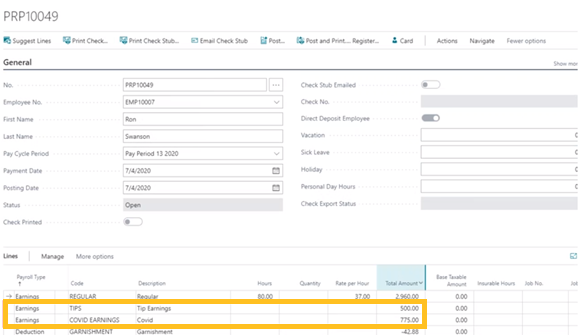

The following image displays how the wage base is reduced by the qualified earnings (COVID-EARNINGS in this example) for the social security ER tax.

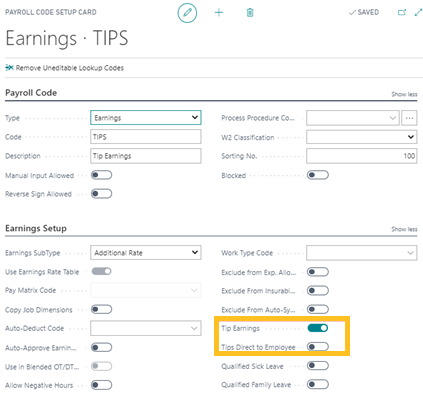

Tips earnings & tips direct to employee

To designate earnings code as tips, on the Payroll Code Setup Card page, on the Earnings Setup FastTab, turn on Tips Earnings. Tips Direct to Employee only designates that tips are being given directly to the employee at the store level and does not affect the W2 or the 941.

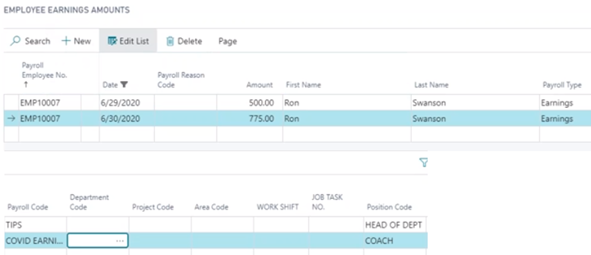

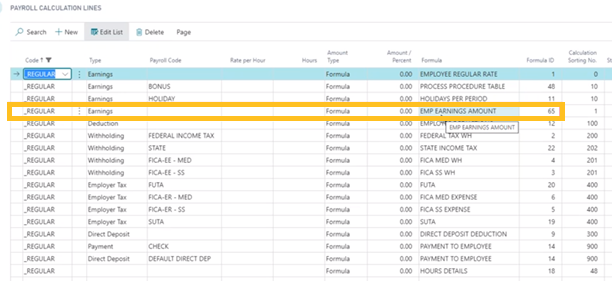

Employee earnings amount table

The following images display the Employee Earnings Amounts page, an employee earnings amount formula line, and a payroll document with earnings amounts.

To include employee earnings amounts in a payroll document, the earnings amount formula must be inserted into a payroll calculation formula's lines.

The Employee Earnings Amounts page provides the capability to set up custom earnings amounts with details, such as Department Code, Project Code, Area Code, Work Shift, Job Task No., and so on.

If you want to use the employee earnings amounts, in the payroll calculation lines, add a line with a type of Earnings, a blank Payroll Code, and the formula EMP EARNINGS AMOUNT.

The sum of the employee earnings amounts populated in the payroll document based on the payroll code.

Updated 941

Note

Note:

The 941 is no longer searchable. To access and run the 941 report, from the Full Payroll Menu, choose US Tax Reports > 941 Report.

To view a 941 that is based on the tips and covid earnings that have been created for these release notes, select the following link:

https://www.dropbox.com/s/9fugowkkrv12xli/16.7.0.0%20Form%20941%20%2816%29.pdf?dl=0

You can see in lines 5a(i) and 5a(ii) Qualified Sick Leave wages and Qualified Family Leave are in Column 1 and are multiplied by the reduced social security percentage of 6.2% (EE side only).

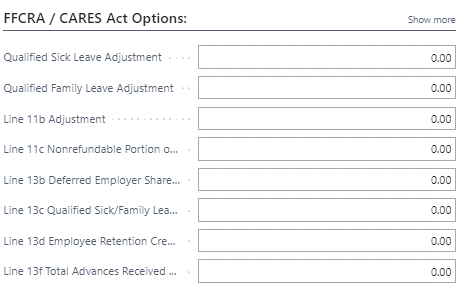

Line 11b: 11b brings in the qualified earnings plus the 1.45% ER side of Medicare, and also the allocable health insurance on qualified earnings. The allocable health insurance can be overwritten in the report options screen as required.

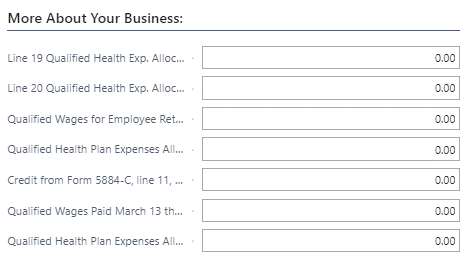

Line 19 : Qualified health plan expense allocable to qualified sick leave wages. This amount can be overwritten in the options page of the report.

Line 20 : Qualified health plan expense allocable qualified family medical leave wages. This amount can be overwritten in the options page of the report.

The following images display the new fields in the options page of the 941 report:

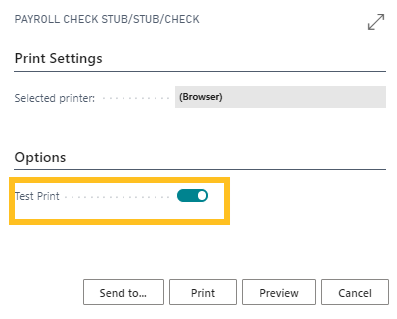

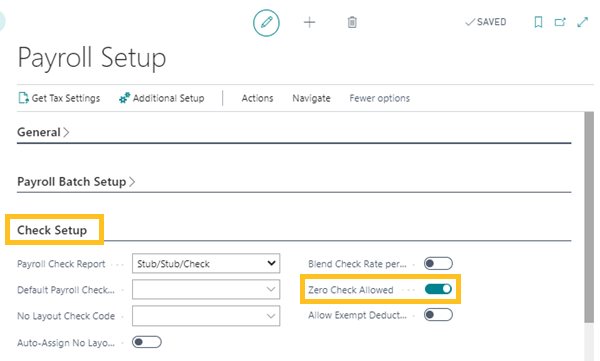

Test print

To print a check stub before you export the electronic file, turn on Test Print.

Note

Note:

To test print a check stub before exporting the ACH file, on the Payroll Setup page, Zero Check Allowed must be turned on.

Related information

Feedback

To send feedback about this page, select the following link: