Payroll release notes version 17.12.0.0

These release notes include supplemental information about the payroll release version 17.12.0.0.

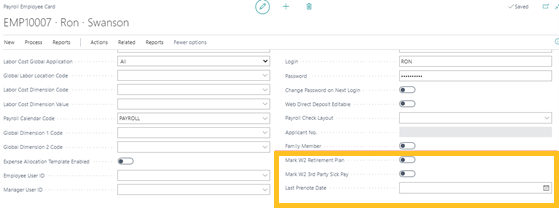

W2 employee card settings

Mark W2 Retirement Plan, Mark W2 3rd Party Sick Pay, and Last Prenote Date are new fields on the Payroll Employee Card page.

The following list includes information about these new fields:

Mark W2 Retirement Plan: If an employee is part of a retirement plan that is not in the payroll system, to override the default W2 setting, turn on this field.

Mark W2 3rd Party Sick Pay: To mark the W2 3rd Party Sick pay box on the employee level, turn on this field.

Last Prenote Date: This field works together with Create Multiple Employee Prenote File.

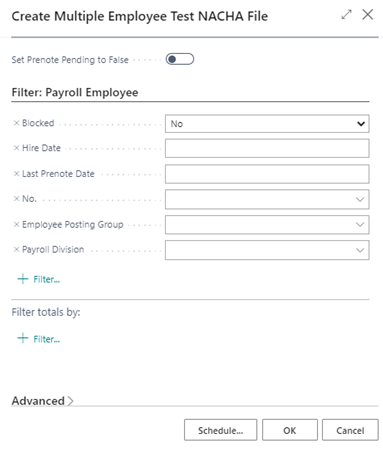

Create multiple employee prenote file

This functionality allows you to mass update employee prenote statuses. You can filter employees by hire date, employee number, employee posting group or payroll division, and then turn on or turn off their prenote pending status in bulk, instead of updating each employee individually.

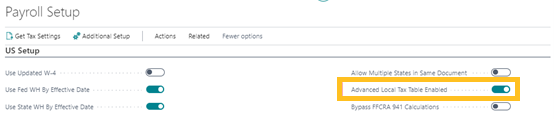

Advanced Local Tax Setup Enabled

The Advanced Local Tax Setup Enabled field provides the capability to set up employees with multiple work localities or any variation of local tax setup requirements.

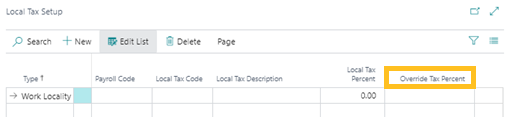

Override Tax Percent overrides the tax percent that is set in the tax table. This functionality helps in situations where localities have reciprocal agreements or other scenarios that require the local tax table settings to be overridden.

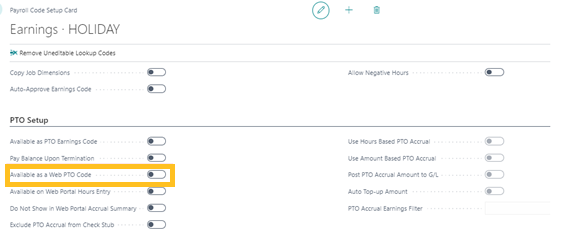

Available as a Web PTO Code

The Available as a Web PTO Code field provides the capability to set a PTO code as being available on the web.

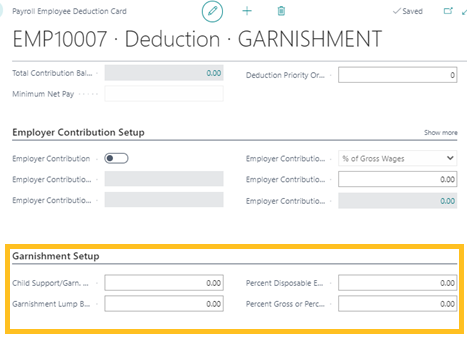

Garnishment setup

If a deduction code has Garnishment turned on, the Garnishment Setup FastTab appears on the Payroll Employee Deduction Card page. The Garnishment Setup FastTab has decimal fields that are commonly used in garnishment calculations. The garnishment calculations can be used in the garnishment process procedure calculation.

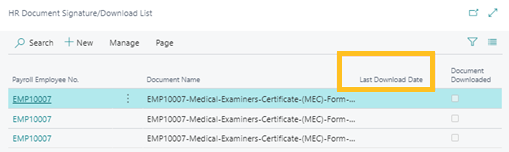

Last Download Date

If an employee downloads a file from the web portal, on the HR Document Signature/Download List page, in the Last Download Date field, you can see the download date.

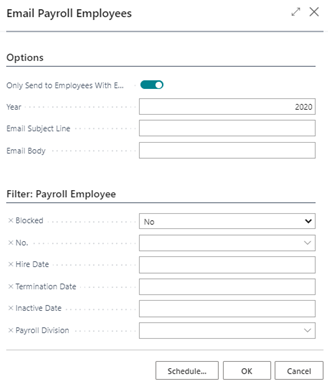

Send email to payroll employees

This feature allows you to send a mass email to employees based on a variety of different filtering options. This feature can be used to update employees about how they can access the employee portal, along with login and password information.

To help prevent sending mass emails to inactive employees, you can turn on Only Send to Employees with Earnings. Also the Year field can be used to filter out any employees that do not have earnings for the year that is specified in the field.

Split deductions

This is a multi-state setting that allows for exempt deductions to be split into multiple states depending on where the earnings were incurred.

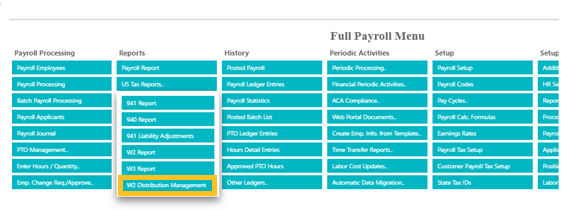

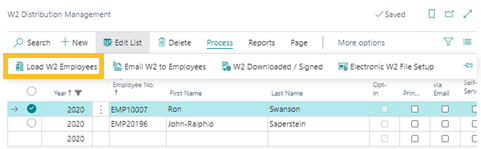

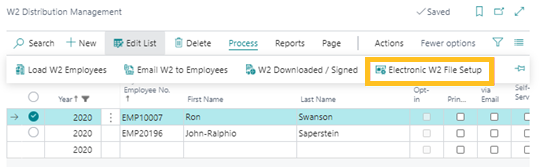

W2 distribution management

The Load W2 Employees action loads all your employees who have earnings in the year that is selected.

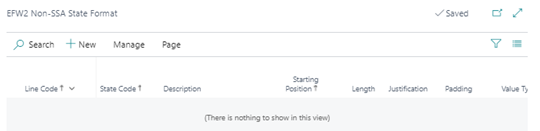

EFW2 Non-SSA State Format

This setup is for states that require a different format than the SSA's recommendation.

Related information

Feedback

To send feedback about this page, select the following link: